how likely will capital gains tax change in 2021

Historically major changes to US tax policy have not been retroactive. A key issue is whether the change would apply retroactively to April 2021.

How To Calculate Capital Gains Tax H R Block

With the proposed rates under the Biden tax plan the taxes on this.

. Former Vice President Joe Bidens tax plan would take away the preferential 20 maximum capital gains rate for those with income levels about 1 million. Ad Browse discover thousands of brands. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396.

Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a 396 top capital gains rate for sales. If you have a 500000 portfolio be prepared to have enough income for your retirement. Implications for business owners.

Capital Gains Tax reform likely to happen within 12 months warns corporate finance expert. Read customer reviews find best sellers. These included aligning rates of CGT to income tax levels and cutting the.

And CGT reform was again overlooked on Tax Day on 23 rd March 2021. This could result in a significant increase in CGT rates if this recommendation is implemented. If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners.

Ad Download The 15-Minute Retirement Plan by Fisher Investments. And if retroactive taking. The OTS review of CGT published in September suggested four key changes as part of an overhaul.

Capital Gains Tax is expected to rise in 2021 in many countries including the UK and US. History is a good indicator of the impact of a capital gains increase on. Long-Term Capital Gains Taxes.

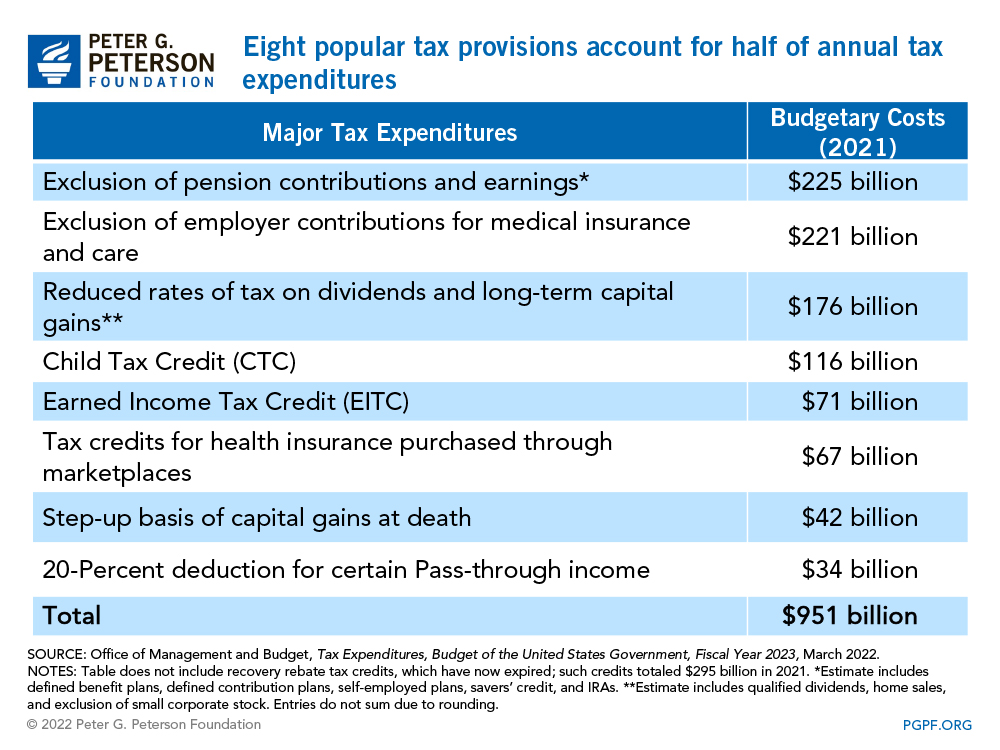

The changes in tax rates could be as follows. This will affect the after-tax proceeds received by an e-commerce business owner who. The chart below illustrates how the change in capital gains tax rates affects the sellers net proceeds.

Many speculate that he will increase the rates of capital gains tax to help raise. Under the current rules a 100000 long-term capital gain would face a 23800 tax bill at the federal level. Proposed changes to Capital Gains Tax.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Select Popular Legal Forms Packages of Any Category. Any amount above the basic tax rate will hit the 20 charge on assets and 28 for residential property.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. All Major Categories Covered. The capital gains tax-free allowance for the 2021-22 tax year is 12300.

The current capital gain tax rate for wealthy investors is 20. The Chancellor will announce the next Budget on 3 March 2021.

Capital Gains Tax What Is It When Do You Pay It

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

How Do Marginal Income Tax Rates Work And What If We Increased Them

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Trust Tax Rates And Exemptions For 2022 Smartasset

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

How High Are Capital Gains Taxes In Your State Tax Foundation

Can Capital Gains Push Me Into A Higher Tax Bracket

How Are Dividends Taxed Overview 2021 Tax Rates Examples

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)